Regulations — the favorite punching bag of every guy with a yacht, a tax shelter, and a Twitter account where he posts photos of himself holding a sink. Conservatives talk about “cutting red tape” like it’s a noble crusade. But let’s be clear: that “red tape” is the thing keeping your drinking water from giving you superpowers (the bad kind), your mortgage from vanishing overnight, and your kid’s breakfast cereal from containing uranium dust.

But go ahead, tell me more about how deregulation creates jobs.

Spoiler: It doesn’t. Not unless you count “hazmat cleanup” as a booming industry.

Let’s talk about what happens when the rules get tossed out the window and the market is left to its own “invisible hand” — which, by the way, seems to mostly punch downward.

Love Canal, Times Beach, and the entire premise of Erin Brockovich didn’t just happen in a vacuum. These weren’t just “bad actors.” These were the results of industry being trusted to “self-regulate.” That’s corporate-speak for “We pinky promise not to poison anyone, unless it’s more profitable to do so.”

Or how about Texas in 2021, when deregulated energy markets left people literally frozen in their homes while energy companies raked in record profits. “Freedom!” isn’t so free if you’re boiling snow for water.

But let’s fast-forward to one of the biggest deregulation bonanzas of our time: the 2008 financial crisis.

Here’s the short version: In the late ‘90s and early 2000s, a toxic cocktail of deregulation hit the financial sector. The Glass-Steagall Act — which had kept commercial banking separate from investment banking since the Great Depression — was repealed. Wall Street was unleashed to invent all sorts of creative financial “products” that even the people selling them didn’t understand. Mortgage-backed securities, credit default swaps, subprime loans — basically, casino chips backed by the hopes and dreams of people just trying to buy a house.

The result? A speculative bubble inflated by fraud, greed, and a total lack of oversight. Then it popped. Hard. Millions lost their homes. Millions more lost jobs, savings, retirements. Meanwhile, the banks that caused the crisis? Got bailed out. CEOs got bonuses. You got a recession.

And that, my friends, is the magic of deregulation.

Now let’s talk nuclear power — because nothing says “trust us” like radio active isotopes.

Ask the folks who lived through Chernobyl or Fukushima what happens when safety gets sacrificed for profits. In Japan, the Fukushima meltdown wasn’t just a natural disaster — it was a regulatory disaster. Investigations later revealed that warnings were ignored, risks were downplayed, and the industry was basically policing itself. Spoiler: It wasn’t.

And before you say, “Well, that’s overseas,” remember that Three Mile Island happened here. In Pennsylvania. In the land of “free markets” and “innovation.” The partial meltdown was a wake-up call that regulations — inconvenient as they may be for the profit margin — are the only thing keeping us from glowing in the dark.

And now: Your Brain on Deregulation – But why stop at the environment or the economy? Let’s move on to the brains of our children — brought to you by deregulated tech bros who totally care about your kids.

Social media platforms — yes, those unregulated dopamine slot machines in your pocket — have become the modern-day equivalent of lead paint for your kid’s brain. TikTok, Instagram, YouTube — they’re all designed to keep users scrolling, clicking, comparing, consuming. And since there are basically no rules, they’ll shove whatever content keeps eyeballs glued to the screen: disinformation, conspiracy theories, body image nightmares, cyberbullying, and literal teen mental health crises.

And what do the CEOs say when they’re dragged in front of Congress? “We’re committed to safety.” Sure. Just as long as it doesn’t interfere with quarterly earnings.

There’s a reason the people who build these platforms don’t let their own kids use them.

These aren’t accidents. These are results. These are the logical endgame of removing every safety net under the guise of “freedom.” Spoiler: it’s not your freedom they care about. It’s theirs — to profit, pollute, and never face consequences.

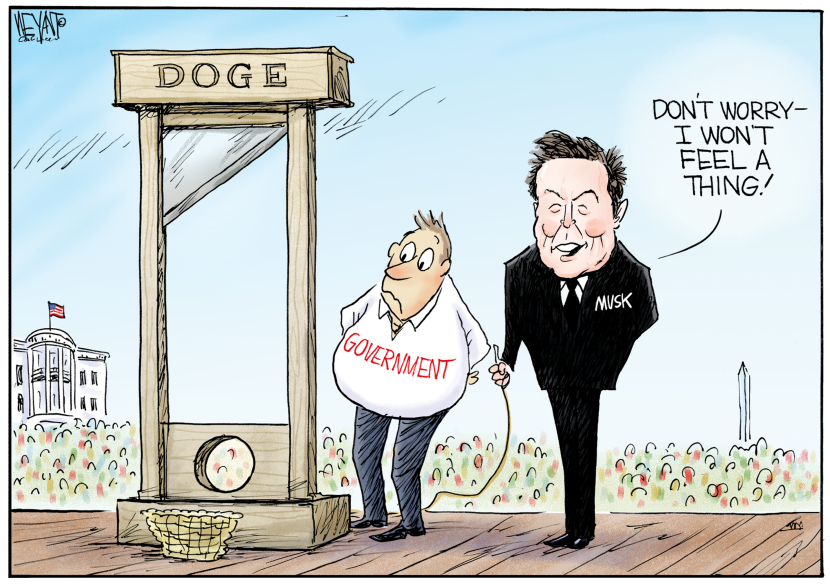

Enter Elon Musk: a man who wants to colonize Mars, but thinks Earth has too many rules.

In 2023, he proposed “zeroing out regulations,” as if we’re all just one IRS form away from becoming SpaceX engineers. But let’s be honest: this isn’t a libertarian thought experiment — this is a billionaire looking for a cheat code.

Because here’s the truth: deregulation doesn’t hurt people like Musk. He’s not living next to the factory spewing out mystery fumes. He’s not drinking from the contaminated well. He’s not working the night shift with no OSHA oversight and no air conditioning. He’s tweeting about “freedom” from a private jet while ordinary people are left to clean up the mess.

And when things go wrong — and they always do — he won’t be the one left holding the bag. You will. Your community. Your lungs. Your savings. Your future.

So here’s a challenge:

Name one federal regulation that, if repealed, would make your life better.

Go on, I’ll wait.

Because most regulations exist for a reason. They were born from hard lessons and real suffering. Clean Air Act? That came after skies were filled with smog and kids had asthma by age six. Financial regulations? We learned what happens when you don’t have them. Labor laws? Your 40-hour week and weekends didn’t come from corporate generosity — they came from regulation.

What the right calls “red tape,” the rest of us call protection — from exploitation, from pollution, from economic collapse. It’s the guardrail between you and the abyss.

The Bottom Line is that Deregulation isn’t about helping you. It’s about freeing the powerful from responsibility. It’s about letting the few do whatever they want while the rest of us carry the cost — in our paychecks, our health, our environment.

So when someone tries to sell you on “less government, more freedom,” ask them: whose freedom are we talking about? Because if it’s the freedom to dump toxins in your backyard, crash the economy, and walk away richer, that’s not freedom. That’s theft.

Regulation isn’t the enemy of prosperity. It’s the reason prosperity is even possible for people who don’t have lobbyists. It’s the only thing standing between corporate power and the rest of us. And frankly, we need more of it — smarter, stronger, and unapologetically on the side of public good.

So yes. We love regulations.

And once you’ve lived through a world without them?

You will too.