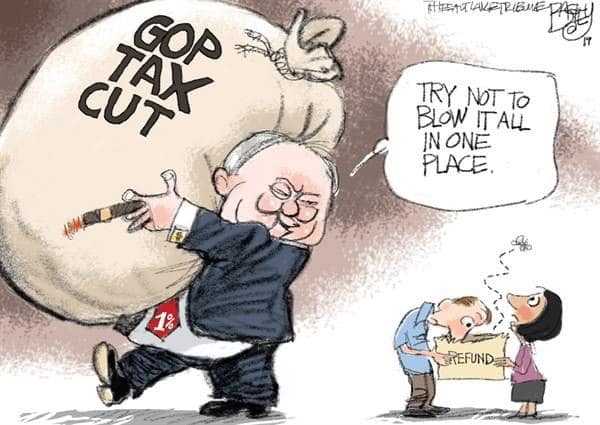

TAX CUTS—the perennial promise of “prosperity” peddled by politicians. We’re told that slashing taxes, especially for the ultra-wealthy and colossal corporations, will ignite economic growth, create jobs, and somehow, miraculously, pay for themselves. It’s a narrative as old as trickle-down economics itself, and just as false.

The lie of Trickle-Down Economics- It goes like this: cut taxes for the rich, and they’ll invest more, spurring job creation and wage growth that benefits everyone. In reality, this “trickle-down” is a scam resulting in the greatest economic inequality in history and massive national debt. CEOs and billionaires aren’t the benevolent job creators they’re made out to be; they’re profit maximizers. When their tax bills shrink, they most often channel the money into stock buybacks, dividends, and offshore accounts rather than into worker salaries or new hiring.

To understand the disparity, consider the U.S. household income distribution:

Under $50,000: Approximately 38% of households.

$50,000 to $75,000: Around 17% of households.

$75,000 to $100,000: About 12% of households.

$100,000 to $200,000: Roughly 23% of households.

Over $200,000: Approximately 10% of households.

Despite the majority earning less than $100,000, tax policies disproportionately favor those in the highest brackets. Also, they are immune from Social Security contributions at this income.

Let’s break down the beneficiaries of these tax cuts:

2017 Tax Cuts: Distribution by Income Bracket

According to the Tax Policy Center, the average tax changes by income percentile for 2018 were as follows:

Lowest 20% (Income up to ~$25,000): Average tax cut of approximately $60.

Second 20% (Income ~$25,000 to ~$48,600): Average tax cut of about $380.

Middle 20% (Income ~$48,600 to ~$86,100): Average tax cut of around $930.

Fourth 20% (Income ~$86,100 to ~$149,400): Average tax cut of approximately $1,810.

Top 1% (Income over ~$732,800): Average tax cut of about $51,140.

These figures illustrate that higher-income households received substantially larger tax cuts, both in absolute terms and as a percentage of their income.

Projected 2025 Tax Cuts: Anticipated Distribution

As of April 2025, discussions are underway to extend and expand the 2017 tax cuts. While exact figures are yet to be finalized, preliminary analyses suggest a continuation of the previous pattern:

Top 0.1% of Earners: Could receive an average tax cut of approximately $314,000 if the individual and estate tax provisions are fully extended.

Top 1% of Households: May see tax cuts averaging around $61,090 in 2025.

In contrast, lower and middle-income households are projected to receive minimal benefits, with some analyses indicating potential tax increases for these groups. For instance, the middle 20% of earners could face an average TAX INCREASE of about $1,500.

The Ballooning National Debt

As of March 6, 2025, the U.S. national debt stands at a staggering $36.56 trillion. Servicing this debt isn’t cheap; in fiscal year 2025 alone, interest payments are projected to total $952 billion, consuming a significant portion of federal spending. This escalating debt is largely attributable to successive tax cuts that have slashed government revenues without corresponding spending reductions.

The Tax Gap: Unpaid Taxes Bleeding the Treasury

Compounding the issue is the tax gap—the difference between taxes owed and those actually paid. The IRS estimates an annual gross tax gap of around $696 billion. This shortfall exacerbates the fiscal strain, limiting the government’s ability to fund essential services.

The Cost of Priorities: Why We Can’t Have Nice Things

So, why do we lack universal healthcare, top-tier public education, and robust clean energy initiatives? It’s not due to a lack of resources but a siphoning off of our tax dollars toline the pocket of the CEO class and their political hacks. The revenue lost to tax cuts and unpaid taxes could have been invested in programs that benefit all Americans, not just the privileged few.

It’s Time to reclaim our future – The lie that tax cuts for the wealthy stimulate the economy is a sweet smelling bull shit. In reality, these policies have led to increased national debt, underfunded public services, and greater economic inequality. It’s time to challenge the status quo, demand fair tax policies, and invest in a future where prosperity is shared, not hoarded. Our collective future depends on it.